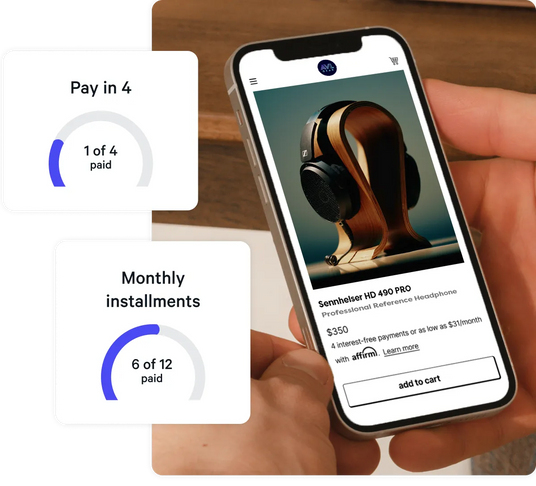

Flexible payment choices

Pay in 4

Split your purchase into 4 interest-free, bi-weekly payments

Monthly Installment

Enjoy the flexibility of 3, 6, 12, 24 or 36-month payment plans

Choose Affirm at checkout

Just select Affirm at checkout when shopping at your favorite stores to see your payment options. Subject to eligibility.

How payment plans work

| Features |

|

|

|---|---|---|

| Purchase amount | $50–$399.99 | $50–$20k |

| Number of payments | 4 | 3, 6, 12, 18, 24, and up to 36 months |

| Payment duration | Every 2 weeks | Monthly |

| Payment at checkout | Down payment may be required | Down payment may be required |

| Interest | Interest-free | Offer 0% APR installment loans up to 12 months |

| Fees? | Never | Never |

| Credit impact to apply? | No impact to apply. If you decide to pay with installments through Affirm, your payment plan and repayment activity may be reported to credit bureaus if loan is accepted. You can find more information on Affirm's Help Center. | No impact to apply. If you decide to pay with installments through Affirm, your payment plan and repayment activity may be reported to credit bureaus if loan is accepted. You can find more information on Affirm's Help Center. |

| Credit impact with a loan? | May impact if delinquent | May impact if loan is accepted or delinquent |

Frequently Asked Questions

Will Affirm impact my credit score?

Will Affirm impact my credit score?

Creating an Affirm account and checking your purchasing power will not impact your credit score. If you decide to buy with Affirm, these things may impact your credit score: making a purchase with Affirm, your payment history with Affirm, how much credit you've used, and how long you’ve had credit.

Am I eligible to use Affirm?

Am I eligible to use Affirm?

To apply, you must meet these eligibility requirements: be a resident of the U.S. (including U.S. territories), be at least 18 years old, have a social security number, and have a phone number that receives SMS. Canadian resident? You can also use Affirm in Canada.

How do I pay Affirm back?

How do I pay Affirm back?

The easiest way to manage your payments is through your account on affirm.com or in the Affirm app. Once you sign in, you’ll be able to see your payment schedule and turn on AutoPay.

What does purchasing power mean?

What does purchasing power mean?

Your purchasing power is an estimate of how much you can spend with Affirm and it’s not a guarantee. You’re not on the hook to pay back this amount until you confirm your loan at checkout. For more information, visit our help center.

How do I get a refund?

How do I get a refund?

When you get a payment plan through Affirm to make a purchase at a store, Affirm pays the store for the total amount of your order upfront. Then you pay in installments to Affirm the loan amount you used for your purchase.

If you believe you are due a refund for your order, first contact the store directly where you made your purchase to confirm the refund. Affirm can't issue refunds or cancellations without confirmation from the store. The store will let you know if a return is possible and how much the refund will be, if eligible, according to their own return policy.

Once we receive confirmation from the store, the refund amount will show up in your loan timeline within 3–10 business days, and your balance will be updated. Different stores can issue different refunds according to their policy like partial or full amount refunds. For more information on how refunds work and how a refund will impact your payment plan, see About refunds.