Shop Now, Pay Later

Discover the Flexibility of Afterpay

Budget smarter by paying with Afterpay:

-

Get everything you need now.

Shop thousands of brands and millions of products, online and in-store.

-

Pay over time

Choose to pay over 6 or 12 months or in 4 interest-free payments.

-

No fees when you pay on time. (Only for Pay-in-4)

We’ll send you reminders and cap late payments to help you get back on track.

Pay weekly or monthly

-

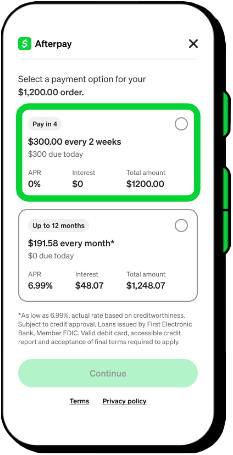

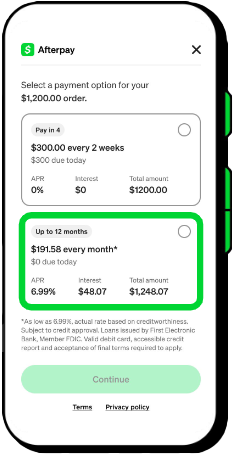

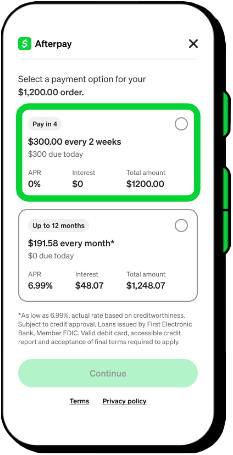

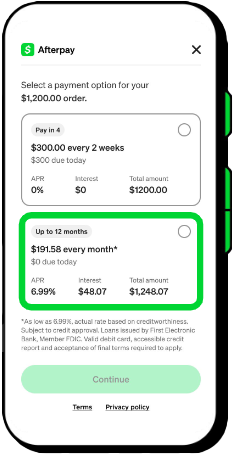

Pay in 4

Pay in 4 installments, over 6 weeks

Orders from $1 - $2,500

Always, always interest free

-

Pay Monthly

Pay over months(6-12), not weeks

Orders from $400 - $4,000

For qualified customers, there's a no finance charge(0% APR) option

Frequently Asked Questions

How does Afterpay work?

How does Afterpay work?

Simply shop with one of your favorite stores found in the Shop Directory and choose Afterpay as your payment method at checkout. First-time customers will need to create an Afterpay account (with instant approval decision) and returning customers will simply log in to make their purchase. For online orders, the goods will be shipped to you by the retailer after checkout. For in-store shopping, download the Afterpay mobile app, follow the in-app instructions and complete the eligibility checks to see if you are eligible to set up the Afterpay Card. If eligible, you can use the Afterpay Card with Apple Pay or Google Pay to make a contactless payment at checkout.

At any time, you can log in to your Afterpay account to see your payment schedule and make a payment before the due date. Otherwise, we’ll automatically process payments on the due dates, as outlined on your payment schedule.

You may have multiple installments due on the same date, depending on when your orders were placed. Installments that are due on the same and have the same eligible payment method, may be automatically bundled and processed in one transaction at Afterpay’s election.

This applies to Pay in 4 orders only, and can include multiple bundled payments processed on the same day. Pay Monthly orders are not included.

We’ll send you a payment confirmation email with a breakdown of your payments. This email will provide you with a breakdown of the payment so you can identify which installments were paid.

Please Note: Afterpay does not approve 100% of orders. We are committed to ensuring we support responsible spending.

When determining which orders to approve, we consider a number of different factors. As an example, the longer you have been a shopper using Afterpay and the more orders you have successfully repaid, the more likely you will be able to spend more.

Things to consider

- Are there sufficient funds on your card? Generally we look to see the first installment amount available to spend.

- The length of time you have been using Afterpay

- The amount you have to repay

- The value of the order you are trying to place

- The number of orders you currently have 'open' with us

While we know it can be frustrating to not know exactly how much you can spend each time or how many active orders you can have, our rules and approval process help Afterpay responsibly offer our service to our customers.

Does Afterpay conduct credit checks?

Does Afterpay conduct credit checks?

Afterpay may conduct a soft credit check for new customers when they first sign-up to use the platform. This soft credit check will not impact a customer’s credit score.

Soft credit checks (also known as soft pulls or soft inquiries) are very common and will not affect credit scores, will not be visible to other lenders or creditors and may or may not be recorded in credit reports, depending on the credit bureau.

Afterpay takes a number of factors into account when making a decision to approve a new customer, a soft credit check is one of those factors.

We will also do a credit check if you use the Pay Monthly option while checking out. This is part of the assessment to determine your eligibility for this product, as well as the APR that can be offered.

Monthly Payments - What is it? How does it work?

Monthly Payments - What is it? How does it work?

Afterpay’s Pay Monthly product is an installment loan. Upon approval, you may be offered a flexible way to pay for high-value orders over 6 or 12 months! Each merchant varies on what they will allow customers to spend. Generally, Merchants allow purchases from generally $400 to $4,000. Although, a few select Merchants generally have purchase limits from $200 - $5,000.

How does the APR work with Afterpay monthly payments?

The term APR (Annual Percentage Rate) is the yearly cost to borrow. Pay Monthly is a simple interest loan with no late fees or an origination fee. The interest accrues daily based on the outstanding principal balance. Please refer to the Truth In Lending Disclosure in the Loan Agreement that will outline the total finance charge.

How is my APR calculated?

The APR is formulated by several different factors. To determine your creditworthiness we look at information obtained from your credit profile to past payment history with us at Afterpay!

Where can I shop with Pay Monthly?

Monthly payments are available to customers in the U.S and is not available for all merchants. If available, the option to choose ”Pay Monthly” will be presented during checkout. Eligibility for the Pay Monthly option requires a soft credit check that has no impact on your credit profile. Please note that until an offer is selected, rates and offers are subject to change.

Pay Monthly is not available in:

- Nevada

- West Virginia

- Hawaii

- New Mexico

Click here to find your favorite stores that offer monthly payments.

When will my first payment be taken?

When will my first payment be taken?

For all Pay Monthly or Pay in 4 orders, the first payment is due at the time of checkout. We will send you a confirmation email outlining the amounts and dates that the payments are due.

Pay Monthly

Pay Monthly payments are due on the same day every month for the duration of the loan. You can find your due date and monthly payment amount in your Final Payment Schedule in the app or web portal. If you need to cancel a scheduled payment, please contact us via the app at least 3 business days prior to the scheduled payment date.

*Please note that a down payment may be required

Pay-in-4

Your first payment is due the day your order request is approved. Subsequent installments will be due approximately every 2 weeks.

If your preferred payment day has been set:

For non Californian residents

Post checkout, the 2nd installment will be due a minimum of 8 days and a maximum of 14 days from the purchase date to align with your preferred payment day.

For California residents:

Post checkout, the 2nd installment will be due a minimum of 15 days and a maximum of 21 days from the purchase date to align with your preferred payment day.

First payment higher than the other three?

For some purchases, if your total order amount exceeds your Available to spend the first payment may be higher than subsequent payments. We will show you how the installments are split before you pay.

Please note: If you wish to stop payments from being debited from your debit card, ACH, or Cash App Pay we require you to contact us at least 3 business days prior to the scheduled payment date. If you have contacted us with less than 3 business days notice, we will assist with your request, however we may be unable to revoke authorization for your next scheduled payment date successfully. If you revoke this authorization, you understand that you will be responsible for making your payments by another payment method. Please refer to our Terms for further information.

Is there a cost to using Afterpay?

Is there a cost to using Afterpay?

Afterpay is a free service when you pay on time - there are no upfront fees charged or any interest incurred.

The only fees that may be incurred are late fees if your scheduled payments are unsuccessfully processed and, after being notified, you do not log in to your Afterpay account to make your payment via a different method.

We do everything we can for you to avoid late fees, including sending reminders leading up to the payment due date.

Shoppers in the USA may receive up to an $8 late fee for each missed installment but the total late fees for each order won't exceed 25% of the order value.

Monthly Payment

Afterpay Monthly Payment is a simple interest installment-based lending option that gives you more flexible ways to pay for high-value orders. Depending on your eligibility, Pay monthly offers flexibility with a 6 and 12 month interest-based payment option on items over $400. Interest accrues on the unpaid principal balance on a daily basis. Please note, until an offer is accepted rates and offers are subject to change

How many orders can I have with Afterpay?

How many orders can I have with Afterpay?

Afterpay promotes responsible spending because anything else is bad for you, bad for our merchant partners and bad for Afterpay. As we learn more about each other we can work together to help you plan, buy and pay for more of things you need.

If you are brand new to Afterpay and trying to use our service multiple times, you will be declined. Your spending limit will be tailored to your history with Afterpay.

This way you stay in control of your money and we can make sure that you really commit to our community of responsible spenders.

The longer you are with us, spending responsibly and making payments on time, your spending limits will likely increase and you will hopefully be able to carry out more orders at one time.

How do refunds and returns work at Afterpay?

How do refunds and returns work at Afterpay?

First, the merchant has to process the refund in their system. The refund will then drop through to reflect on your Afterpay account, and if you're owed a refund back to your card, it will be returned to the card that was used to make the payments.

Once processed, the money can take up to 10 business days to be returned to your card/s, depending on your financial institution.

It is important to remember that returns are always subject to the merchants refund policy. This information can normally be found on their website or by contacting the merchant directly.

My order has been returned/canceled. Why am I still being charged?

My order has been returned/canceled. Why am I still being charged?

The most important thing to do first is check your emails! Afterpay will always send you an email to let you know that your refund is on its way. If you have not received this email, it means that the merchant has not processed your refund/order cancelation.

Have you checked with the merchant?

Once the refund is processed by the merchant, it will automatically reflect in your Afterpay app and your payments will be adjusted according to the amount that has been refunded. In most cases this will be very quick, but in some cases the refund can take 3-5 days to reach your Afterpay order.

What about cancelations for orders that I have not yet made payments on?

Sometimes it can take a few days for the merchant to process the order cancelation. This is normal, and typically no cause for concern! If a few days have gone by and your order has not be adjusted or canceled, you can reach out to the merchant and ask them for an update.

What about orders that I have made payments towards and money is due to be returned to my card?

After making a return, it may take several days for the merchant to accept the return and process a refund, especially if you've returned items via mail. Until the refund is confirmed and processed by the merchant, your original payment schedule with Afterpay will continue. You can also push back your next payment to allow time for the refund to be processed. If you are wanting an update about the status of the refund, please reach out to the merchant directly.

Waiting for a refund to be processed?

If it is a Pay in 4 order you can push back your next payment to allow time for the refund to be applied. Click here to find out more.

If it is a Pay Monthly order we are unable to change the due date since the due date is fixed for the life of the loan.